Still paying off your student loans?

You may qualify for student loan forgiveness through the Public Service Loan Forgiveness Program

Student debt is often offered without the education of long term effects of compound interest on fees and how it might effect their financial prosperity down the road. Fortunately for millions of Americans, the federal government offers the Public Service Loan Forgiveness Program to employees of:

-

Federal, state, local, or tribal government organizations

-

A 501(c)3 nonprofit

-

A not-for-profit that’s not 501(c)3 designated but meets other requirements related to public service

-

AmeriCorps, in a full-time capacity, or the Peace Corps

How to Find a Plan

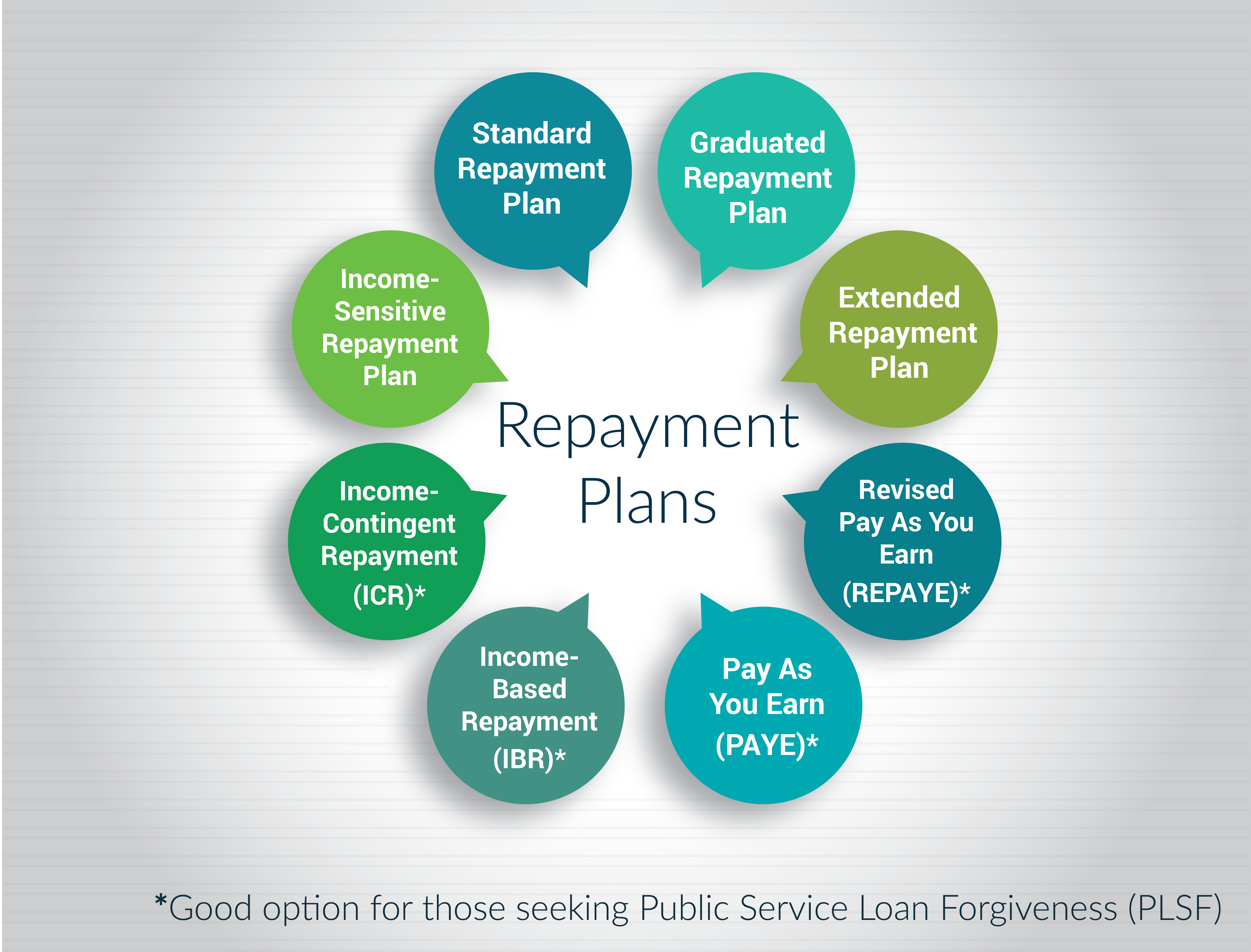

Finding a forgiveness plan which suits you is very important. Every repayment plan offered by the government makes students eligible for forgiveness, however it is really important to find the program which suits you the most. The three most common repayment plans are: Income-Contingent Repayment Plan, Income-Based Repayment Plan, and the Pay as You Earn Repayment Plan.

What you should know about student loans

Any person that has borrowed money from a qualified lender may apply to receive loan forgiveness. Websites such as Studentaid.ed.gov and Myfedloan.org provide an overview of the qualification requirements.

Federal loans are funded by the federal government while private loans are funded by a lender such as a bank, credit union, state agency or school. A detailed list of the similarities and differences can be found on Studentaid.ed.gov.

If you are into public service, it does not mean that your loan will be forgiven at once. However, to get eligible for this plan, you should make 120 payments of your loan on time. It is also mandatory that you should be employed by a non-profit or a government organization during the time of all these payments.